Can You Count Vet Bills On Taxes . Learn what expenses you can deduct in order to recover the cost of. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. Web the types of costs you can deduct include grooming, food, veterinary care and training. Web you generally can’t count those bills as itemized medical deductions. If you have a service animal, you may get a tax break under the medical expense. However, the internal revenue code does. You might also be able to claim vet bills on taxes. Tax deductions for service animals.

from www.mybunny.org

Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. Learn what expenses you can deduct in order to recover the cost of. Web you generally can’t count those bills as itemized medical deductions. You might also be able to claim vet bills on taxes. Web the types of costs you can deduct include grooming, food, veterinary care and training. If you have a service animal, you may get a tax break under the medical expense. However, the internal revenue code does. Tax deductions for service animals.

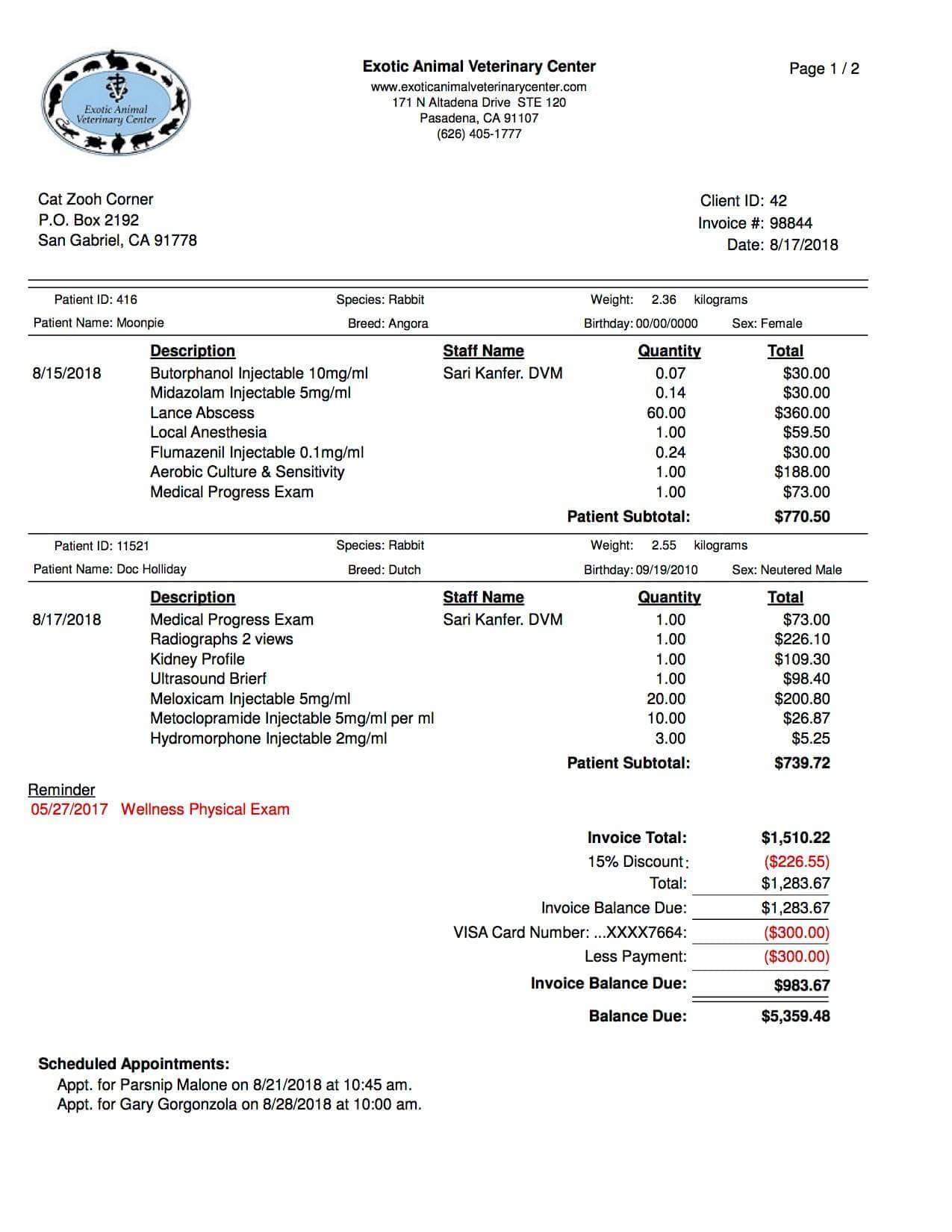

Urgent Help Needed to Pay Vet Bills Zooh Corner Rabbit Rescue

Can You Count Vet Bills On Taxes You might also be able to claim vet bills on taxes. You might also be able to claim vet bills on taxes. Learn what expenses you can deduct in order to recover the cost of. If you have a service animal, you may get a tax break under the medical expense. Web the types of costs you can deduct include grooming, food, veterinary care and training. Tax deductions for service animals. Web you generally can’t count those bills as itemized medical deductions. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. However, the internal revenue code does.

From fabalabse.com

What happens if I can’t afford my vet bill? Leia aqui How do you Can You Count Vet Bills On Taxes However, the internal revenue code does. Web the types of costs you can deduct include grooming, food, veterinary care and training. Learn what expenses you can deduct in order to recover the cost of. Web you generally can’t count those bills as itemized medical deductions. Tax deductions for service animals. Web you can write off any medical expenses that exceed. Can You Count Vet Bills On Taxes.

From dogpackr.com

How to pay vet bills, even in emergencies dogpackr Can You Count Vet Bills On Taxes Web the types of costs you can deduct include grooming, food, veterinary care and training. Web you generally can’t count those bills as itemized medical deductions. You might also be able to claim vet bills on taxes. However, the internal revenue code does. Learn what expenses you can deduct in order to recover the cost of. Web you can write. Can You Count Vet Bills On Taxes.

From www.mybunny.org

Urgent Help Needed to Pay Vet Bills Zooh Corner Rabbit Rescue Can You Count Vet Bills On Taxes Learn what expenses you can deduct in order to recover the cost of. However, the internal revenue code does. You might also be able to claim vet bills on taxes. Web you generally can’t count those bills as itemized medical deductions. Web the types of costs you can deduct include grooming, food, veterinary care and training. Tax deductions for service. Can You Count Vet Bills On Taxes.

From topdogtips.com

7 Tips on How to Save Money on Vet Bills Top Dog Tips Can You Count Vet Bills On Taxes Learn what expenses you can deduct in order to recover the cost of. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. If you have a service animal, you may get a tax break under the medical expense. Tax deductions for service animals. However, the internal revenue code does.. Can You Count Vet Bills On Taxes.

From thestuffofsuccess.com

5 Tips for Paying Veterinary Bills ⋆ The Stuff of Success Can You Count Vet Bills On Taxes However, the internal revenue code does. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. Web the types of costs you can deduct include grooming, food, veterinary care and training. You might also be able to claim vet bills on taxes. Tax deductions for service animals. Web you generally. Can You Count Vet Bills On Taxes.

From freeanimaldoctor.org

Paul Free Animal Doctor Can You Count Vet Bills On Taxes However, the internal revenue code does. You might also be able to claim vet bills on taxes. Web you generally can’t count those bills as itemized medical deductions. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. Tax deductions for service animals. Web the types of costs you can. Can You Count Vet Bills On Taxes.

From tailwagwisdom.com

6 Cool Ways Dog Parents Pay For Vet Bills Tail Wag Wisdom Can You Count Vet Bills On Taxes Tax deductions for service animals. However, the internal revenue code does. If you have a service animal, you may get a tax break under the medical expense. Web you generally can’t count those bills as itemized medical deductions. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. Learn what. Can You Count Vet Bills On Taxes.

From www.pinterest.com

7 Hacks To Save You Money At The Vet in 2021 Emergency vet, Vet bills Can You Count Vet Bills On Taxes Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. Web the types of costs you can deduct include grooming, food, veterinary care and training. Learn what expenses you can deduct in order to recover the cost of. You might also be able to claim vet bills on taxes. If. Can You Count Vet Bills On Taxes.

From www.pinterest.com

Vet bill HELP Vet bills, Pet insurance reviews, Canine cancer awareness Can You Count Vet Bills On Taxes Web the types of costs you can deduct include grooming, food, veterinary care and training. You might also be able to claim vet bills on taxes. Learn what expenses you can deduct in order to recover the cost of. Tax deductions for service animals. Web you generally can’t count those bills as itemized medical deductions. If you have a service. Can You Count Vet Bills On Taxes.

From dogpackr.com

9 Tips to Save Money on Vet Bills for Your Dog dogpackr Can You Count Vet Bills On Taxes Learn what expenses you can deduct in order to recover the cost of. Tax deductions for service animals. Web the types of costs you can deduct include grooming, food, veterinary care and training. Web you generally can’t count those bills as itemized medical deductions. However, the internal revenue code does. If you have a service animal, you may get a. Can You Count Vet Bills On Taxes.

From dogpackr.com

How to pay vet bills, even in emergencies dogpackr Can You Count Vet Bills On Taxes Learn what expenses you can deduct in order to recover the cost of. If you have a service animal, you may get a tax break under the medical expense. Web you generally can’t count those bills as itemized medical deductions. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service.. Can You Count Vet Bills On Taxes.

From www.pinterest.com

Vet bill help Vet bills, Financial assistance, Vets Can You Count Vet Bills On Taxes If you have a service animal, you may get a tax break under the medical expense. Learn what expenses you can deduct in order to recover the cost of. Web the types of costs you can deduct include grooming, food, veterinary care and training. You might also be able to claim vet bills on taxes. However, the internal revenue code. Can You Count Vet Bills On Taxes.

From www.thriftyfun.com

Saving Money on Veterinary Expenses ThriftyFun Can You Count Vet Bills On Taxes You might also be able to claim vet bills on taxes. Learn what expenses you can deduct in order to recover the cost of. Tax deductions for service animals. However, the internal revenue code does. Web the types of costs you can deduct include grooming, food, veterinary care and training. Web you can write off any medical expenses that exceed. Can You Count Vet Bills On Taxes.

From www.youtube.com

Help With Vet Bills How to Get Help Paying Vet Bills Vet Bills Dogs Can You Count Vet Bills On Taxes Web the types of costs you can deduct include grooming, food, veterinary care and training. However, the internal revenue code does. Learn what expenses you can deduct in order to recover the cost of. Web you generally can’t count those bills as itemized medical deductions. If you have a service animal, you may get a tax break under the medical. Can You Count Vet Bills On Taxes.

From lifehacker.com

How to Pay Expensive Vet Bills Without Going Broke Can You Count Vet Bills On Taxes Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. You might also be able to claim vet bills on taxes. Web you generally can’t count those bills as itemized medical deductions. However, the internal revenue code does. Learn what expenses you can deduct in order to recover the cost. Can You Count Vet Bills On Taxes.

From www.pinterest.com

VET BILL ASSISTANCE Animal hospital, Vet bills, American animals Can You Count Vet Bills On Taxes However, the internal revenue code does. You might also be able to claim vet bills on taxes. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. Tax deductions for service animals. Web the types of costs you can deduct include grooming, food, veterinary care and training. Learn what expenses. Can You Count Vet Bills On Taxes.

From dogpackr.com

How to pay vet bills, even in emergencies dogpackr Can You Count Vet Bills On Taxes Web you generally can’t count those bills as itemized medical deductions. Tax deductions for service animals. If you have a service animal, you may get a tax break under the medical expense. However, the internal revenue code does. Web you can write off any medical expenses that exceed 7.5% of your adjusted gross income, which may include service. Learn what. Can You Count Vet Bills On Taxes.

From www.dreamstime.com

Paying for vet bill stock photo. Image of bull, account 12360144 Can You Count Vet Bills On Taxes Web you generally can’t count those bills as itemized medical deductions. If you have a service animal, you may get a tax break under the medical expense. However, the internal revenue code does. Tax deductions for service animals. You might also be able to claim vet bills on taxes. Learn what expenses you can deduct in order to recover the. Can You Count Vet Bills On Taxes.